Buying a house is not as good as buying REITs? In the United States, REITs offer diverse opportunities and the market outlook is optimistic!

2024/10/26

• Is Buying REITs Better Than Buying Property?

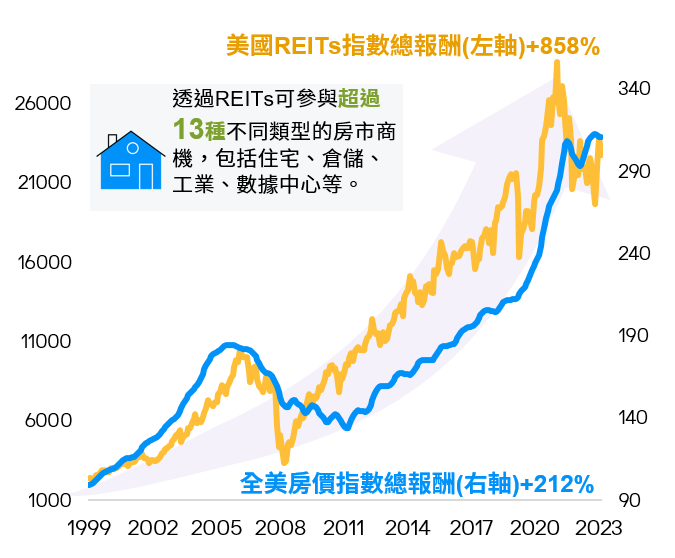

Since 2000, US home prices have shown a long-term upward

trend, but US REITs have outperformed during the same

period, demonstrating that REITs' diversified industry

exposure can better capture investment opportunities from

economic transformation over the long term.

• REITs Offer Diverse Opportunities - Both Income and

Growth:

The US is the world's largest REITs market, currently

offering access to over 13 different types of real estate

opportunities. Beyond traditional residential, office, and

shopping center REITs, non-traditional REITs like healthcare

facilities, warehouses, and data centers have emerged in

recent years. Thus, investing in REITs can meet investors'

income needs while capturing growth opportunities in

emerging economic sectors.

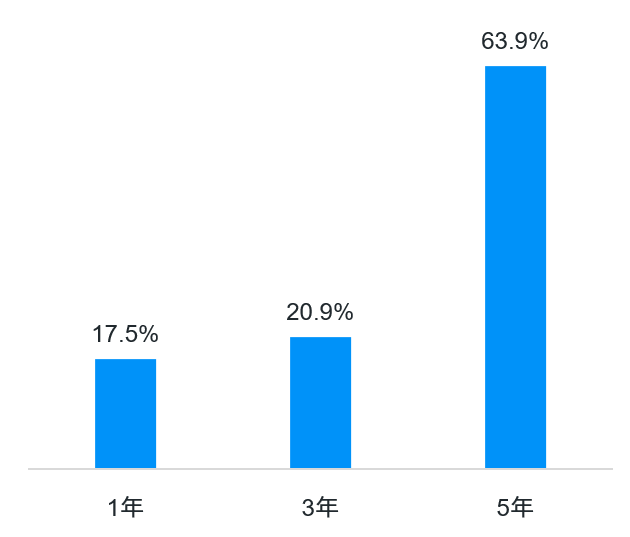

• Rate Cut Expectations Still Outweigh Hikes - REITs

Benefits Emerging:

Although the Fed may maintain current policy rates for

longer, future rate cuts remain more likely than hikes.

Since 2000, there have been three instances when the Fed

paused rate hikes, with US REITs delivering strong average

performance over the subsequent 1, 3, and 5 years. When the

next rate cut cycle begins, US REITs are expected to

continue attracting capital inflows, supporting future

performance.

US REITs Have Strong Long-Term Performance and Could

Benefit From the Fed's Coming Rate Cut Cycle

US Home Price Index vs. US REITs Index Performance Since

2000

Source: Bloomberg, data as of December 31, 1999-January

31, 2024.

Average Performance of US REITs 1, 3, and 5 Years After the Fed Paused Rate Hikes (Three Instances Since 2000)

Source: Bloomberg, data as of the average performance of

US REITs 1/3/5 years after the Fed's last rate hikes on

May 16, 2000; June 29, 2006; and December 19, 2018. US

Home Price Index is S&P/Case-Shiller US National Home

Price Index, US REITs Index is FTSE NAREIT All Equity

REITs Index.

Past performance is not a reliable indicator of current

or future results. Illustrations based on the above

indices - investors cannot invest directly in indices.

Housing, Clothing, Food, Transportation, Education,

Entertainment

US REITs Let You Be Landlords of Various Property

Types

• REITs originated in the US in 1960, and the US remains the world's largest REITs market today, with a 67% market share*.

• US REITs invest in diversified property types including apartments, office buildings, hotels, shopping malls, warehouses, data centers, etc. Famous properties like New York's Empire State Building, Las Vegas' Fashion Show Mall, Waikiki Beach's Hilton Hawaiian Village, and Amazon's official fulfillment centers are all potential REIT investments.

Source: *EPRA, J.P. Morgan Asset Management, data as

of December 31, 2023.